- Successfully collecting patient payments is driven by clearly defined financial policies, robust digital payment options, and easy automated workflows.

- Enlisting front-office staff to verify insurance, update patient data, and reinforce payment expectations can reduce denials and overdue balances.

- Practices collect more revenue when payments are handled at the time of service.

- Support collection efforts with clear scripts, structured payment plans, and consistent follow-up for outstanding balances.

The success of every medical practice hinges on collecting patient payments. We share a 3-step process for how medical practices can improve collection efforts including setting up payment systems, training staff on payment policies, and establishing clear collection practices.

When trying to navigate the complexities of healthcare, independent practices face many challenges including those related to medical billing. And these challenges are often compounded by things like complicated insurance rules, confusing regulations, coding errors, and high administrative costs.

To make collecting patient payments easier, it’s important to evaluate and improve current medical billing processes, implement new payment policies, and train staff on billing and payment best practices. We take a closer look at ways medical practices can increase their collections and ensure a healthier financial future.

Step 1: Set up systems to successfully collect patient payments

Establishing a successful patient payment collection process starts with evaluating your current practices to determine what is and isn’t working and making strategic adjustments.

Understand your patient collection process and how success is measured

- Collection rate: Take note of the percentage of outstanding patient balances that are collected within a specific timeframe. The higher the collection rate, the more successful the collection process.

- Days in accounts receivable (AR): Track the average number of days it takes to collect payments from patients and insurance companies. The lower number of days in AR, the better.

- Aging of accounts: Categorize outstanding balances by age (30 days, 60 days, 90 days, etc.). A successful collections process has a smaller percentage of accounts in aging buckets.

- Percentage of write-offs: Review the percentage of outstanding balances that are adjusted as uncollectible. Lower percentages indicate a more effective collection process.

When calculated and compared, these metrics can help guide your practice in making adjustments to current billing policies and protocols for a higher rate of success.

Establish and communicate a strong payment policy

After you have a better understanding of your current medical billing practices, it’s time to assess your practice’s current financial policy or develop a new one.

To get started, answer the following questions:

- Will patients be required to cover copays during check-in?

- Will patients be required to have a valid credit card on file?

- Will patients be allowed to pay on a payment plan?

- Will patients need an insurance referral (if required) to schedule an appointment?

- How will communications regarding outstanding balances be communicated to patients?

- What payment options will your practice offer?

- What about policies regarding non-payment?

Once created or updated, take steps to reduce the administrative burden on your staff by providing clear training on payment protocols. Additionally, take steps to improve the patient experience by clearly communicating payment expectations and prominently displaying payment policies in highly visible areas including:

- Your practice website

- The desk or wall in your reception area

- Patient registration forms

- Patient portal

Use technology to expedite and increase collection efforts

Practices can leverage technology to make the patient payment process easier. And having the right tech tools can reduce the time and money your practice spends on collecting efforts. Consider implementing the following practices:

- Store credit card information for later use

- Set up online billing and collections

- Create automated payment plans

Medical practices can also use technology to quickly collect and verify insurance information to inform patients about the pricing of services and their financial responsibility after insurance is applied. This step can help reduce the amount of time and effort administrative staff spend following up with patients.

Additionally, according to Tebra research, patients appreciate having a patient portal to:

- Check in online

- Share their insurance information

- Provide an image of their insurance card

Your practice can also improve patient satisfaction by empowering patients to quickly input and verify demographic and insurance information by providing a self-service kiosk in your office.

Partner with a reputable medical billing company

Make the collections process even easier by partnering with a medical billing company that has a proven success rate. With the processes and systems in place to take on the administrative load that comes with billing, a medical billing company can use technology like robotic process automation (RPA) to quickly automate billing processes. Technology like RPA can help your practice:

- Speed payments

- Reduce expenses

- Track metrics

Practices that partner with a successful medical billing company can improve clean claim rates, reduce the number of days in accounts receivable, promote timely payments, and increase net collections.

Train staff to provide the information patients need

Delays in payments may be related to confusion and questions patients have about their medical bills and your practice’s billing policies. According to a 2024 Healthcare Financial Experience Study, 56% of surveyed patients said they felt stressed trying to understand what they owed and 28% of these patients said their confusion led to a delay in paying their medical bills.

To combat confusion and avoid payment delays, train front office, medical, and billing staff to interpret and clearly communicate important payment information to patients.

"To combat confusion and avoid payment delays, train front office, medical, and billing staff to interpret and clearly communicate important payment information to patients."

One way healthcare organizations can help patients is to clearly explain how waivers work.

When it’s clear a patient’s insurer will not reimburse for the service, a practice should obtain a financial waiver. Medicare requires the use of an Advance Beneficiary Notification (ABN) for certain services to alert beneficiaries of the patient financial responsibility. These waivers notify patients upfront of their out-of-pocket financial obligation before performing the service.

Medicare requires practices to provide ABNs at the point of care. For example, if a patient wants a B12 shot, it’s important for the tech who administers the shot to advise the patient (if applicable) that Medicare will not cover the treatment.

Step 2: Make your front office, the front line for collecting information

The front office team is often the first point of contact for patient engagement and collecting correct patient information, which can lead to better overall collection practices. There are different ways to utilize your front office team to accurately collect patient information and offer direction on collecting payments upfront.

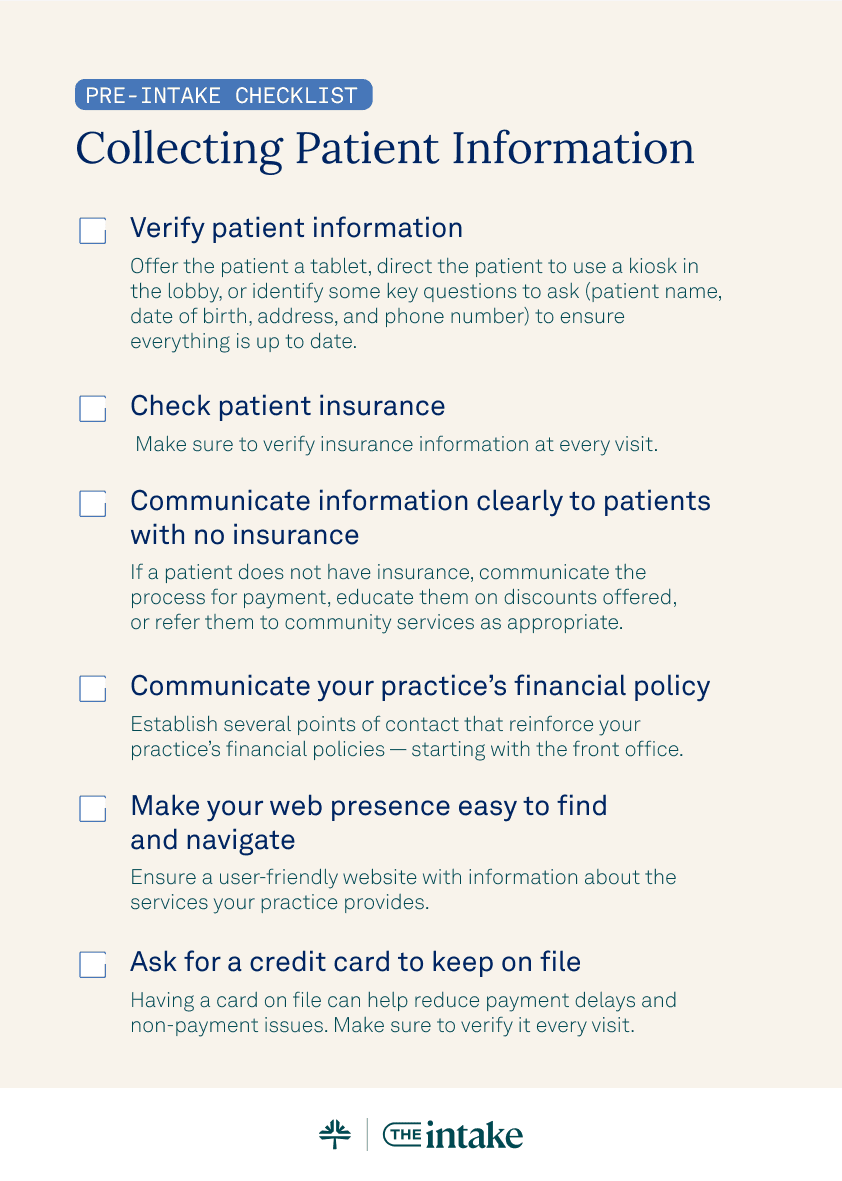

Create a pre-intake checklist for collecting patient information

- Verify patient information: The first thing front-office staff must do when a patient walks through the door is verify their information. A practice can offer the patient a tablet, direct the patient to use a kiosk in the lobby, or identify some key questions to ask (patient name, date of birth, address, and phone number) to ensure everything is up to date.

- Check patient insurance: A Tebra survey shows that 92% of medical billers wished practices did a better job at verifying insurance information. Make sure to verify insurance at every visit.

- Communicate information clearly to patients with no insurance: If a patient does not have insurance, communicate the process for payment, educate them on discounts offered, or refer them to community services as appropriate.

- Communicate your practice’s financial policy: To avoid misunderstandings, establish several points of contact that reinforce your practice’s financial policies — starting with the front office.

- Ask for a credit card to keep on file: Having a credit card on file can help reduce payment delays and non-payment issues. Verify the credit card on file at every visit.

Identify and offer resources to uninsured patients

According to the Kaiser Family Foundation, nearly 1 out of every 10 patients lacks insurance coverage. Practices can assist uninsured individuals in the following ways:

- Develop a charity care policy: Practices can offer free or discounted medical care to people who can't afford to pay.

- Educate patients about available community services: If a patient knows they won’t be able to pay for treatment, practices can refer them to local volunteer or free clinics.

- Refer to pharmaceutical assistance programs: Practices can refer patients to State Pharmaceutical Assistance Programs — programs that offer financial assistance to help pay for prescriptions.

Step 3: Collect patient payments

After a practice takes the time to understand their current payment policies, establishes new systems, and trains staff on collection practices, it’s time to collect payments.

What is the best time to collect patient payments?

Collecting payments at the time of service reduces the time and expense associated with following up and trying to recover payments later. In the case of self-pay patients, practices may be able to incent prompt payment by offering a discount.

Use clear language to communicate collection policies

When interacting with patients about payment, use clear and definitive language. For example, instead of saying, “Would you like to pay?,” use a script similar to, “How would you like to pay today?” You can even write out the receipt — demonstrating your intention to promptly collect.

Set up effective payment plans

It isn’t always possible for a patient to pay their entire bill post-visit. A practice can set up payment plans with effective terms. Elements of an effective payment plan include:

- Establish clear payment timelines and be proactive by asking the patient, “How much more time will you need?”

- Set a minimum monthly payment — targeting payments of $25 or more to cover the cost of administering the plan

- Create bi-monthly plans to align with patients’ payroll cycles

Monitor patient receivables

When a patient is set up on a payment plan, it’s important to have a way to monitor and track payment activity. Create a separate category for patient receivables tied to payment plans and monitor performance. It's also important to establish a protocol for tracking patient receivables to keep abreast of missed payments.

Collect payments post-visit

Paying in full at the point of service isn’t always possible for patients so it’s important that practices establish ways to collect payments post-visit. For example, send emails and text message reminders and provide easy patient payment options like online payment or using a card on file.

Dismiss for payment failure

Establish a dismissal policy for non-paying patients with bad debt. Practices that fail to dismiss non-paying patients are more likely to experience additional problems with non-payment if word gets out that the practice tolerates this behavior.

Collecting patient payments is the lifeline of every practice

To have a healthy revenue cycle, every practice needs to establish effective payment and collection policies and practices. By implementing collection processes that leverage technology, clear communication, and practice staff — healthcare practices can increase their collections and ensure a healthier financial future for their operations.

Make collecting payments easy

Avoid medical billing headaches by partnering with us. Tebra offers billing and payment software to help easily collect patient payments.

FAQs

Frequently asked questions

- Offer digital payment options and store cards on file

- Automate reminders and billing statements

- Train staff to explain financial expectations upfront

- Use integrated tools like Tebra Payments to centralize billing and accelerate revenue

- Enable text/email reminders

- Use simplified, color-coded statements

- Set up recurring payment plans

- Reduce friction with online, mobile, and in-office payment options

- Connect EHR, billing, and payments in one platform

- Sync patient balances automatically

- Use real-time eligibility checks

- Automate ERA processing to speed up collections

- Use automated eligibility verification

- Reduce claim errors with clean data entry

- Provide transparent estimates before visits

- Consolidate financial tools under a single platform

- Reduce manual errors and administrative burden

- Speed up claim submissions and payment reconciliations

- Improve patient satisfaction and boost staff productivity

- Current Version – Dec 18, 2025Written by: Jean LeeChanges: This article was updated to reflect the more relevant and up-to-date information.

- Dec 09, 2025Written by: Erica FalknerChanges: This article was updated to reflect the more relevant and up-to-date information.