- Making sure that accurate insurance payments protect your bottom line and keep reimbursement on track.

- Obtain payer fee schedules and use public rate tools to catch discrepancies and lower payouts in the claims process.

- Establish an automated process to compare payments with expected reimbursement, then follow up to ensure staff prioritize accuracy.

In medical billing, an underpaid claim happens when a payer’s reimbursement is below the contracted allowed amount for a valid claim, according to your insurance contracts and the insurer’s decision.

For your practice’s financial health, having a significant share of insurance payments posted incorrectly is unsustainable. Most payers no longer pay a percentage of charges. They set prices for each service. The challenge is to secure that price on every remittance.

Underpayment can go unnoticed and still harm the bottom line. It also slows cash flow when balances linger. Strengthening your payment tracking and management helps you spot and resolve variance early. The steps below show how to reduce underpaid claims and protect revenue over time.

Know what you should get paid

It is impossible to identify underpayments if you don’t know what you should be paid. Request a current fee schedule from all relevant payers. They may hesitate to share rates for all 10,000-plus CPT codes, so prioritize your top 50 CPT codes, including modifiers. Compile that list and ask each payer to provide its fees for every line.

For healthcare providers, expected reimbursement depends on clear contract terms. Confirm how the full amount is calculated in your insurance contracts and insurance policy terms. Record the allowed amounts you expect to receive in medical billing, so your team can compare posted payments against those figures and quickly identify any spot variances.

"Request a current fee schedule from all relevant payers."

Explore other sources

When direct pricing information is difficult to obtain, you can reference these alternative sources to estimate reimbursement rates:

- Medicare and Medicaid schedules. These programs publish official reimbursement rates that serve as reliable benchmarks.

- The Centers for Medicare and Medicaid Services’ Physician Fee Schedule look-up tool. This online tool lets you check CPT allowances and validate expected reimbursement.

- State workers’ compensation schedules. Most states post these publicly, providing another point of comparison for common services with predictable medical costs.

Commercial remittance comparisons. Because commercial contracts vary widely, use public benchmarks to evaluate remittances and check them against your contract terms. Document any discrepancies for follow-up.

Try alternate strategies

If you are signing up with a payer for the first time, require a list of rates for your specialty’s top services to accompany the contract before you commit. Ask for written confirmation of how those rates apply. Also, flag plan exclusions that affect rates and require written clarification.

Use the provider manual for chat, email, or customer service contacts if you already have a contract. Some payers have expedited provider lines or assigned representatives. Reach out, document each contact, and follow up. Keep supporting documentation ready for the appeals process.

If attempts fail, write to the medical director for the fee schedule. If you don't receive a response, write again and copy your state insurance commissioner. Many states require an insurance company to respond. If you are unsure, ask your medical society. Some practices seek a brief free consultation with healthcare counsel if negotiations stall.

Establish a process to ensure payments are correct

Knowing your rates is step one. Getting paid at those rates is step two. Manual EOB audits are slow and prone to missing details. Instead, opt for automation that stores fee schedules and checks each line item as remittances arrive. That makes discrepancies visible the day they post.

Integrate underpayment detection into your revenue cycle to trigger work queues when discrepancies occur. Review by line item to confirm the allowed amount and modifiers. Treat any underpayment with the same urgency as denied claims and track resolution times.

"Integrate underpayment detection into your revenue cycle to trigger work queues when discrepancies occur."

Payers may underpay claims due to configuration or timing. Document the variance, assign an owner, and request correction in writing. Update stored rates when contracts change to protect cash flow. Define clear steps in the claims process for verification, appeal, and resubmission. Close the loop by logging outcomes. Over time, those notes reveal patterns you can fix at the source.

Use this step-by-step process to detect and resolve underpaid claims using automation:

Evaluate staff motivation

Determine whether incentives push speed over accuracy. Tracking key performance indicators, such as days in A/R, is critical, but it can hide underpayments. When payments post below charges, staff clears the balance with a contractual adjustment. That closes the invoice, not the issue.

Promote balanced metrics that reward accurate posting, variance resolution, and clean reimbursement. Review write-offs tied to denied claims and partial payments.

Track variance between expected reimbursement, posted payments, and claim denials to protect cash flow. Audit a sample of closed encounters each month. If patterns appear, retrain workflows, tighten payer rules, and re-check fee schedules.

Recognize that underpayments may not come from insurers

Insurance fee schedules reflect the total allowed amount from the plan and the patient. In many markets, patients face significant medical expenses through widespread deductibles and cost sharing (including coinsurance), as the employer health benefits survey shows.

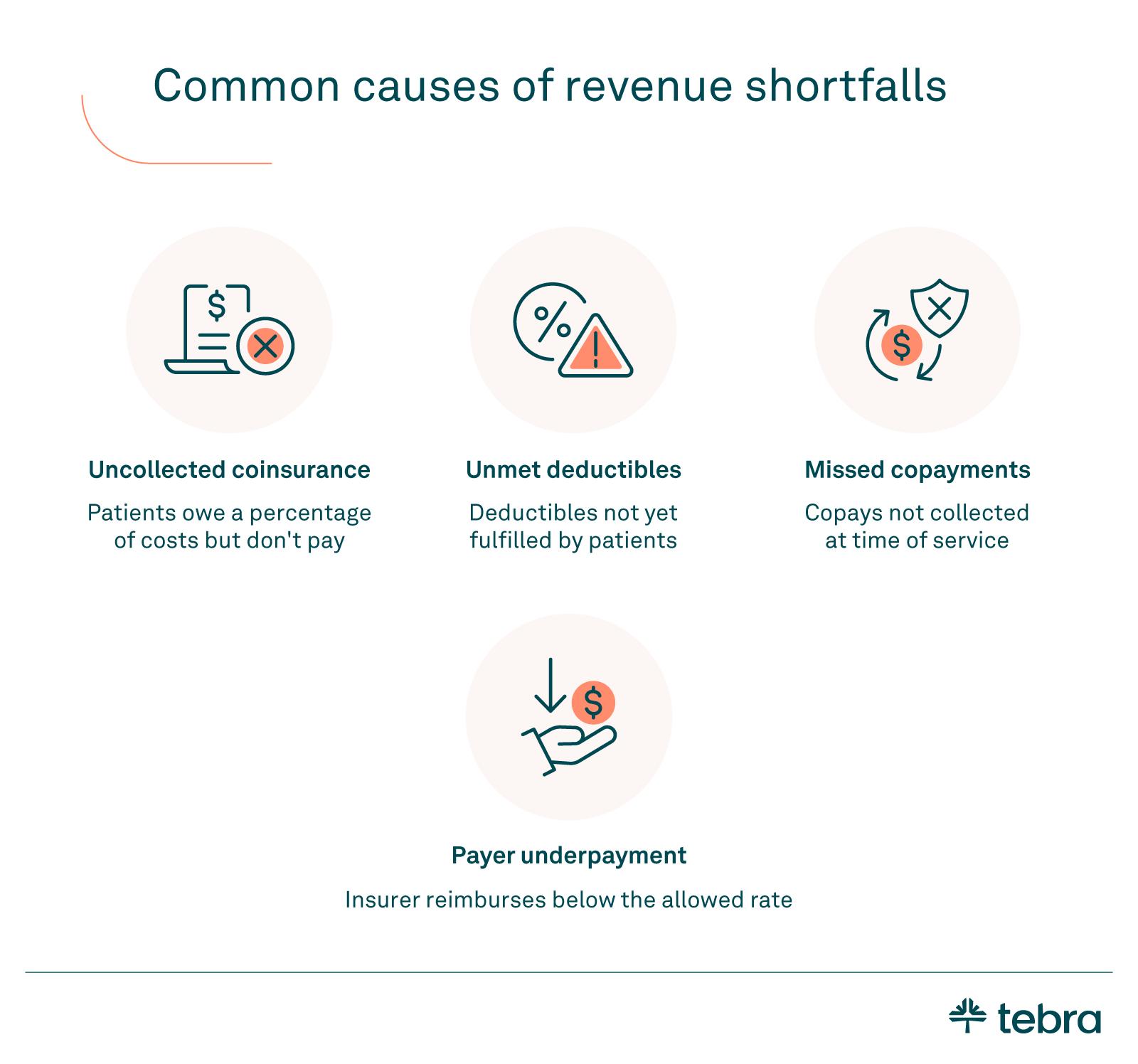

When collections fall short of the expected full amount for contracted services, look first at uncollected coinsurance, unmet deductibles, and missed copayments before assuming payer error.

"Verify insurance coverage, deductibles, and coinsurance balances before visits to protect the full amount without disrupting patient care."

Verify insurance coverage, deductibles, and coinsurance balances before visits to protect the full amount without disrupting patient care. Train front-desk and billing teams to confirm benefits, communicate estimates, and set clear follow-ups for balances.

Strengthen point-of-service collection workflows and document outcomes. Solid pre-visit checks reduce avoidable shortfalls and help your team distinguish between true payer variances and patient-responsibility gaps.

Know when to escalate

If patterns suggest an improper insurer’s decision on underpaid insurance claims, use formal appeal rights first. Follow timelines, reference contract language, and document every step. Your goal is to resolve the variance without disruption.

If issues persist, consider a brief consultation. Allegations of bad faith insurance require legal guidance. Educational content on a law firm website can help you understand options, but advice forms an attorney-client relationship only after engagement.

Reserve legal action for cases where administrative remedies fail and counsel recommends it. Aim for fair compensation based on your contract.

Don’t just pursue medical billing underpayments — prevent them

Prevent underpaid claims by standardizing the workflow: confirm expected reimbursement, automate line item checks, and act quickly on variances in your claims process. Verify benefits, document findings, and use the appeals process when payers do not meet contracted amounts.

Use practical steps to reduce denials and track results over time. If you need a centralized toolkit for tracking, routing, and reporting, explore the Tebra platform. Small, consistent improvements protect cash flow and help private practices get paid accurately, every time. Book a free, personalized demo today.

FAQ:

Quick answers on underpaid claims

You might also be interested in

Learn how to create a seamless patient experience that increases loyalty and reduces churn, while providing personalized care that drives practice growth in Tebra’s free guide to optimizing your practice.

- Current Version – Nov 20, 2025Written by: Jean LeeChanges: This article was updated to include the most relevant and up-to-date information available.