How to streamline the patient payment experience and medical billing process

Get expert insights into medical billing process efficiencies that will help your independent practice or medical billing company be more profitable.

Overview

- Independent medical practices must streamline their medical billing workflows to enhance revenue cycles, reduce claim denials, and ensure financial viability in the face of complex insurance challenges.

- Leveraging digital tools like EHRs, patient portals, and robust revenue cycle management software can significantly improve efficiency, facilitate payments, and optimize workflows.

- As patients shoulder more costs, practices need sophisticated, convenient billing solutions to easily collect payments, safeguard doctor-patient relationships, and enable quality care provision.

It’s no secret: the efficiency and accuracy of a medical billing process — and a correspondingly strong patient payment experience — are crucial to the viability of an independent practice. Medical billing and insurance challenges — already complicated — have grown even more so, resulting in issues like delinquent and denied claims.

The good news? These are challenges that healthcare providers can overcome. By streamlining the patient billing processes in key ways, practices can noticeably improve their revenue cycle. The result is a higher-performing billing system — one that turns being an independent practice into an advantage.

We’re ready to help. Read on for expert insights into medical billing process efficiencies that will help practices, and medical billing companies that services practices, run more smoothly and become more profitable.

How to find efficiencies in your medical billing workflow to better manage patient payments

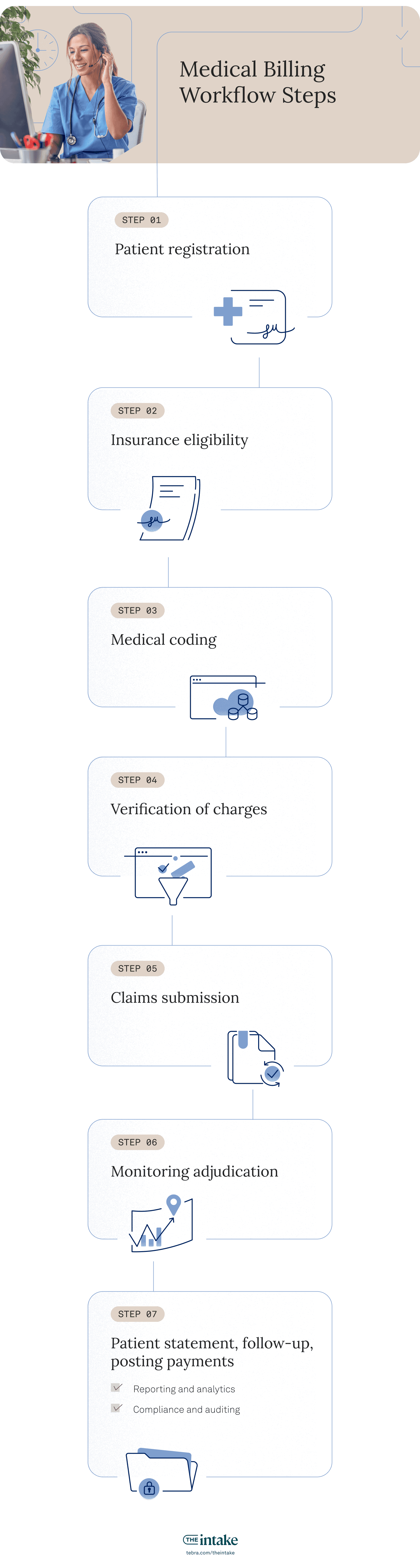

Streamlining your medical billing begins with asking a simple question: what are the steps in the patient billing system? Start by looking at each component, examining the role that each one plays in your overall revenue cycle.

1. Ensure patient information is up-to-date

An accurate, comprehensive patient intake workflow helps ensure a smooth billing process and proper claims submissions. Checking that all relevant patient information and insurance details are provided, accurate, and up-to-date helps save everyone time and effort.

And this isn’t just for new patients — verifying existing patient information on a regular basis makes a significant impact. With nearly one-third of patients changing employers each year, having current insurance information can significantly improve your process.

Efficiency tip: Practices can streamline their patient intake process and make collecting patient payments easier with an automated pre-check-in workflow.

2. Verify insurance eligibility

Practices can streamline claim denial management (and save time) by properly verifying each patient’s insurance coverage. They should check patients' eligibility, coverage limits, deductibles, authorization requirements, and financial responsibility. If their insurance doesn’t cover the procedure or service, front desk staff should make sure the patient is aware they’ll be required to pay in full (or remit a deposit) before they receive a treatment or service.

“Streamline claim denial management (and save time) by properly verifying each patient’s insurance coverage.”

Efficiency tip: Practices can share the eligibility report with patients by providing it to them via a patient portal — or hand it to them when they present.

3. Ensure correct medical coding

Correctly coding the services that the patient received according to the appropriate standardized system — the International Classification of Diseases (ICD) and the Current Procedural Terminology (CPT) — is a critical step in avoiding denials and rejections.

Make sure that the codes are accurate, specific, and current, reflecting the complexity and level of medical necessity of the services. Watch for unbundling: charging separately for items that should be bundled under one code. And under-coding will lose you revenue as well; an AAPC Audit Services study concluded 19% of the visit levels were under-coded.

Efficiency tip: Train staff, including providers, on how to code so they can file an error-free claim.

4. Verify the charges

Before submitting claims, first assess the charges. Ensure accurate coding supported by documentation, and holistically review the claim, checking for any errors, discrepancies, or duplicates that may affect the accuracy of your billing.

Efficiency tip: Use an electronic claims scrubber to check for errors before submitting to insurers.

5. Submit the claim

As you generate the claim form for the insurance company or payer, include all the details you have gathered, including patient information, procedure and diagnosis codes, and a demonstration of the medical necessity for the services provided. Then, submit the claim electronically as per HIPAA guidelines.

“As you generate the claim form for the insurance company or payer, include all the details you have gathered.”

Efficiency tip: Before it reaches the payer, a medical claim often goes through a clearinghouse review, which screens charges and standardizes claims before transmitting them. Choosing the best clearinghouse to work with is an individual choice. Carefully research the features most suited to your needs, the amount of payer connections, the quality of customer service, and if the costs work with your budget.

6. Monitor adjudication

Once the payer adjudication is complete and you receive a report, review it to ensure that all procedures listed on the initial claim are accounted for, that the codes listed match those of the initial claim, and that the fees in the report are accurate.

If you find discrepancies, you’ll need to enter into an appeal process with the payer to secure the proper reimbursement for your services. By submitting clean, accurate claims in the first place, you’ll avoid this long and taxing process.

Efficiency tip: Implement a process for promptly appealing denied claims, which will help recover revenue you might otherwise lose.

7. Create a patient statement, follow-up, and post payments

After practices know the insurance company’s final decision, they can prepare and send a statement to their patient, who will then pay the remainder of their fee (minus what their insurer has agreed to cover).

If a patient is late with a payment, it is the practice's responsibility to contact them directly, send follow-up bills, or, in a worst-case scenario, enlist a collection agency.

Efficiency tip: Get better results with your collection letters. Learn how to write medical practice collection letters that work.

“Make sure patients understand their responsibilities and their payment options.”

Finally, post all payments received from both insurers and patients, accurately documenting all amounts, adjustments, and outstanding balances.

Efficiency tip: Make sure patients understand their responsibilities and their payment options. Send clear bills and statements, invite them to ask any questions, and give them time to do so.

These basic improvements will help you streamline your patient billing and payment process — but there’s more you can do. Beyond these steps in the patient billing system, look out for ongoing best practices to improve accounts receivable in medical billing. These include:

- Reporting and analytics: Analyzing your data on a regular basis will help you gain insights into key performance indicators, claim acceptance rates, claim denial rates, revenue trends, and other metrics. With this data, you can identify areas for improvement, track financial performance, and make informed decisions to enhance your billing workflow.

- Compliance and auditing: Conduct regular internal and external audits to identify potential compliance issues and mitigate financial and legal risks.

How revenue cycle management tools can help you streamline your medical billing workflow

Thanks to the rise of high-deductible plans, patients are shouldering more of the burden to take on a larger share of expenses. This means independent practices have to put more focus — and effort — into collecting payments from them.

This can feel like a burden to staff members, especially when they’re used to requesting small co-pays. Fifty-six percent of practices reported days in accounts receivable have risen, indicating it takes longer to get paid. Outstanding receivables not only place a financial burden on practices and healthcare providers, but they may also strain the doctor-patient relationship.

“Fortunately, digitization has made the patient billing and payment process easier for everyone.”

Patient billing solutions have to meet these challenges. No matter how many efficiencies you look for in your medical billing workflow, without robust revenue cycle billing tools, getting paid in full and on time will remain a struggle.

It comes down to this: today’s practices have to get more sophisticated to make it easier for patients to pay their bills. This often comes down timing and convenience. Fortunately, digitization has made the patient billing and payment process easier for everyone.

According to a 2023 PwC report, “When used correctly, digital tools, including analytics and revenue cycle automation, can manage compliance risks, better protect patient and staff data, reduce healthcare costs, eliminate process inefficiencies, and much more.”

The importance of digital tools for patient payments and medical billing

Digitization is the best way to streamline your medical billing process. Digital tools to ensure a high-performance revenue cycle include:

- Electronic health records system

- A patient portal that includes an online patient payment system

- Revenue cycle management tools, including:

- Pre-check-in

- Insurance coverage and benefits eligibility

- Coding advice and support

- Charge scrubbing

- Denial reporting

- Appeals workflow

- Accounts receivables workqueues

- Real-time collections agency collaboration

These are indispensable billing tools for any successful modern practice. Together, they can significantly optimize workflows and reduce the time spent on revenue cycle management.

The future of medical billing

In today's complex reimbursement landscape, private practices need to rethink revenue cycle management with a focus on medical billing and claims submission. A streamlined, high-performing billing system is essential for practices and patients — and goes a long way toward ensuring financial health while making quality patient care possible.

You might also be interested in

Learn how to create a seamless patient experience that increases loyalty and reduces churn, while providing personalized care that drives practice growth in Tebra’s free guide to optimizing your practice.

- Current Version – Dec 18, 2025Written by: Jean LeeChanges: Updated to reflect the most relevant information available.